Collections Attorneys: Your Secret Weapon for Debt Recovery

Learn how collections attorneys help recover unpaid invoices, protect cash flow, and guide businesses through debt recovery and litigation.

Every business owner knows the frustration of unpaid invoices. They disrupt cash flow, hinder growth, and consume valuable time that could be spent elsewhere. When polite reminders and persistent phone calls no longer work, it can feel like you’re out of options.

But what if there was a powerful ally ready to help reclaim what’s rightfully yours?

This guide explores the vital role of collections attorneys. We’ll show you how these legal professionals can be your secret weapon in recovering debts, protecting your business’s financial health, and ensuring you get paid for the work you do.

We’ll cover everything from what a collections attorney does and when to hire one, to their various services and how they charge. We will also look at the legal boundaries governing debt collection practices and how to find a reputable attorney. When standard collection efforts fall short, and legal action becomes necessary, understanding the broader landscape of Business litigation collections is key.

Our goal is to equip you with the knowledge to steer complex debt recovery, helping you make informed decisions to secure your revenue and peace of mind.

A collections attorney is a legal professional specializing in recovering debts owed to businesses or individuals. Unlike a typical collection agency, an attorney possesses the legal authority to pursue debt recovery through the court system, offering a significantly stronger approach when traditional methods fail. Their primary role is to represent creditors, ensuring that due payments are secured through legal means, while adhering to all applicable laws.

What exactly do collections attorneys do? Their activities span a wide spectrum, commencing with robust pre-litigation strategies and escalating to full-blown legal action if necessary. The typical process a collections attorney follows to recover a debt usually begins with a thorough review of the outstanding debt and supporting documentation. This initial step is crucial for establishing the validity and enforceability of the claim.

Following this, the attorney often issues formal demand letters. These aren’t just polite requests; they are legally backed communications that signal a serious intent to collect. If these demands don’t yield payment or a satisfactory resolution, the attorney may then proceed with filing a lawsuit. This involves preparing and submitting legal documents to the appropriate court, officially initiating legal proceedings against the debtor.

A critical phase in this playbook is asset investigation. Collections attorneys leverage sophisticated tools and databases to locate a debtor’s assets, which can include bank accounts, real estate, vehicles, and other valuable property. This is particularly important because debtors, especially commercial ones, might attempt to hide assets or structure their finances to avoid payment. For instance, the Evanns Collection Law Firm has settled/satisfied judgment debt well into the multiple tens of millions of dollars, often by aggressively employing judgment enforcement methods and using every legal means available to attach/seize/garnish those assets.

Once a judgment is obtained, the attorney moves into judgment enforcement. This can involve various legal actions such as wage garnishments, bank levies, and property liens, effectively compelling the debtor to pay what is owed. The threat of legal action and the actual process of litigation can significantly increase the likelihood of recovery. Statistics show that many businesses wait too long before turning accounts over for collection, but proactive engagement with an attorney can lead to a much higher success rate. Some firms, for example, report commercial debt recovery rates as high as 72%, significantly above industry averages for traditional collection methods.

Types of Collection Services Offered by Business Collections Attorneys

Collections attorneys offer a comprehensive suite of services custom to the specific needs of their clients, whether they are small businesses, large corporations, or individuals. These services are broadly categorized into pre-litigation and litigation/post-judgment phases.

Pre-Litigation Services:

- Attorney Demand Letters: These are formal, legally-drafted letters sent to debtors, outlining the debt, demanding payment, and often threatening legal action if payment is not received by a specified date. The mere involvement of an attorney at this stage can often prompt debtors to take the debt more seriously. This “attorney leverage” can lead to a significant increase in collection rates; some report a 58% increase in collections due to this early legal pressure.

- Debtor Negotiation: Attorneys can engage in negotiations with debtors to establish payment plans, settlements, or alternative resolutions. Their legal expertise allows them to structure agreements that protect the creditor’s interests while maximizing the chances of recovery.

- Asset Location and Due Diligence: Before initiating a lawsuit, attorneys often conduct preliminary investigations to identify the debtor’s assets and financial standing. This helps determine the viability of pursuing legal action and ensures that any judgment obtained can actually be enforced.

Litigation Services:

- Lawsuit Filing: If pre-litigation efforts are unsuccessful, the attorney will prepare and file a lawsuit against the debtor. This includes drafting the complaint, serving the debtor, and managing all aspects of the court process.

- Findy: This phase involves gathering evidence, including documents, interrogatories, and depositions, to build a strong case against the debtor.

- Trial Representation: Should the case proceed to trial, the collections attorney will represent the creditor in court, presenting evidence and arguments to secure a favorable judgment.

Post-Judgment Enforcement:

- Judgment Enforcement: Once a court judgment is obtained, the attorney employs various legal mechanisms to collect the awarded amount. These can include:

- Wage Garnishments: Legally seizing a portion of the debtor’s wages.

- Bank Levies: Freezing and seizing funds from the debtor’s bank accounts.

- Property Liens: Placing a legal claim against the debtor’s real estate or other significant assets, which can force their sale or prevent their transfer until the debt is satisfied.

- Assignment Orders: Court orders that assign a debtor’s rights to receive payments from third parties directly to the creditor.

- Dormant Judgment Revival: Attorneys can also work to revive older, “dormant” judgments to make them enforceable again, extending the period during which collections can be pursued.

These varied services highlight the comprehensive approach collections attorneys take, from initial demand to the final recovery of funds, ensuring creditors have every possible legal avenue explored.

What to Provide Your Collections Attorney

To maximize the effectiveness and efficiency of your collections attorney, providing them with comprehensive and organized information is crucial. The more detail and documentation you can offer upfront, the better equipped your attorney will be to pursue the debt.

Here’s a list of essential documents and information to provide:

- Contracts and Agreements: Any written agreements, contracts, or purchase orders that establish the debt. This includes service agreements, loan documents, promissory notes, and signed proposals.

- Invoices and Statements: Copies of all invoices, billing statements, and account ledgers detailing the charges, payments made, and the outstanding balance. Ensure these are itemized and clearly show the amount owed.

- Communication Records: A complete record of all correspondence with the debtor regarding the unpaid amount. This should include:

- Emails

- Letters (including demand letters you may have sent)

- Fax records

- Detailed notes from phone calls, including dates, times, and summaries of conversations.

- Proof of Goods/Services Rendered: Documentation proving that the goods or services were indeed provided as agreed. This might include delivery receipts, signed work orders, completion certificates, or project milestones.

- Debtor Information: As much identifying and contact information for the debtor as possible:

- Full legal name (individual or business)

- Current and previous addresses

- Phone numbers

- Email addresses

- Any known business registration details (e.g., LLC, corporation)

- Names of principals, owners, or responsible parties for a business debtor

- Social Security Number or Tax ID (if legally obtainable and relevant)

- Payment History: A detailed record of all payments received from the debtor, including dates, amounts, and payment methods.

- Any Disputes or Defenses: Information about any reasons the debtor has given for non-payment, or any disputes they have raised. This helps the attorney anticipate potential defenses.

- Asset Information (if known): Any knowledge you have about the debtor’s assets, such as bank accounts, real estate, vehicles, or other valuable property. While the attorney will conduct their own investigation, any initial leads can be helpful.

- Prior Collection Efforts: Details of any previous attempts to collect the debt, including efforts by internal staff or other collection agencies.

Providing this comprehensive package enables your collections attorney to quickly assess the situation, formulate a strong legal strategy, and proceed with debt recovery efforts efficiently.

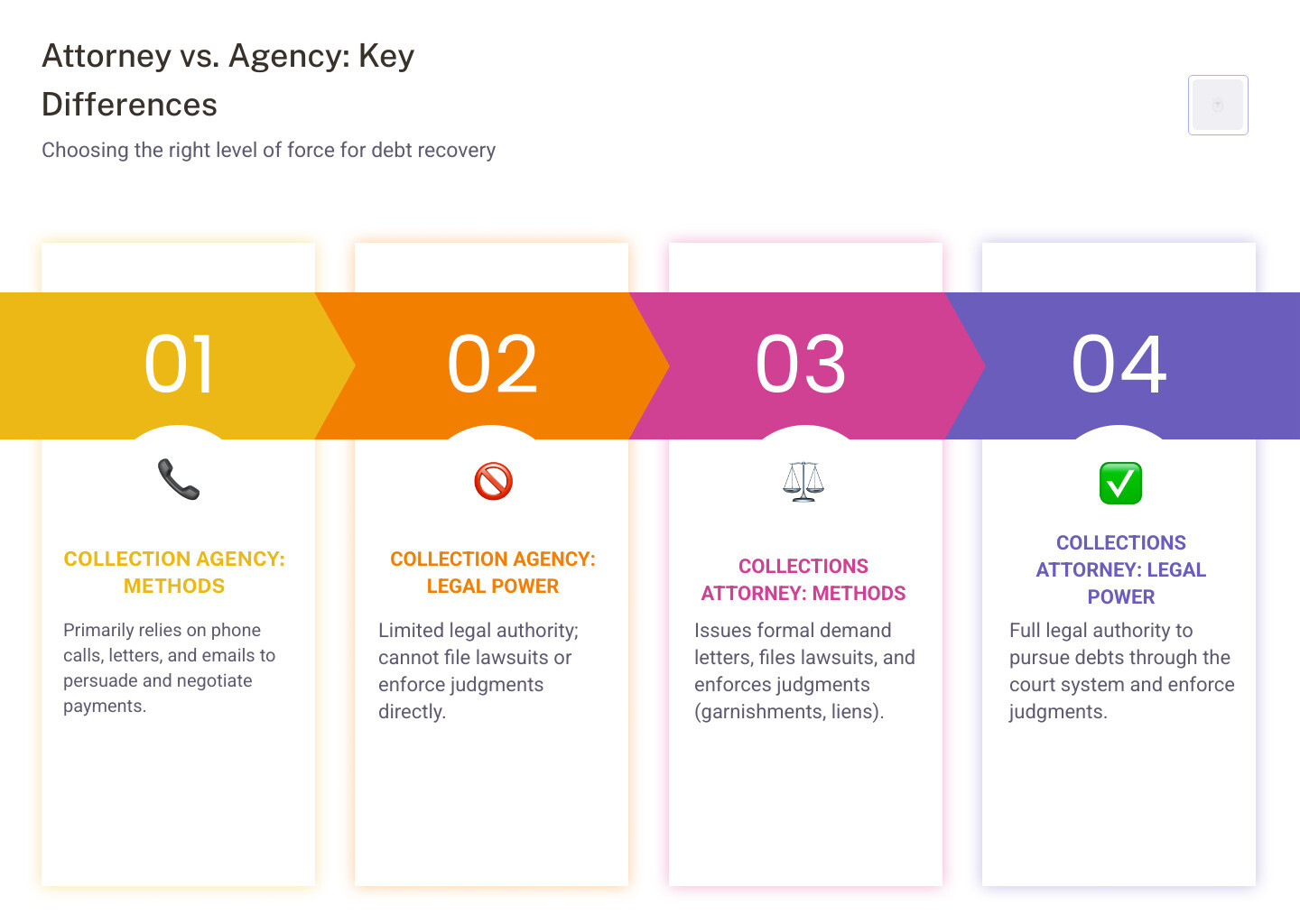

Attorney vs. Agency: Choosing the Right Level of Force

When faced with unpaid debts, businesses often weigh their options between using a traditional collection agency and hiring a collections attorney. While both aim to recover funds, their methods, legal authority, and potential for success differ significantly. Understanding these distinctions is crucial for choosing the right level of force for your debt recovery efforts.

Collection Agencies:

- Methods: Primarily rely on persistent phone calls, letters, and emails. They act as intermediaries, reminding debtors of their obligations and attempting to negotiate payment plans.

- Legal Power: Generally limited. They cannot file lawsuits, garnish wages, or seize assets directly. Their power lies in persuasion and the potential negative impact on a debtor’s credit report.

- Cost: Often work on a contingency fee basis, typically charging 20-50% of the recovered amount.

- Success Rates: The average collection rate for third-party services, including agencies, is often cited around 28%. However, this can vary widely based on the age and type of debt.

Collections Attorneys:

- Methods: Employ the same communication tactics as agencies but with the added weight of legal authority. They can issue formal demand letters, negotiate settlements with the threat of litigation, file lawsuits, and enforce judgments through garnishments, liens, and asset seizures.

- Legal Power: Possess full legal authority to pursue debts through the court system. This includes the ability to obtain judgments, freeze bank accounts, and place liens on property. Under federal law, if a debt collector knows that a debtor has an attorney, they must go through that attorney.

- Cost: Can charge contingency fees, hourly rates, or flat fees, often with hybrid models. Contingency fees for attorneys might be comparable to or slightly higher than agencies, but they often recover more.

- Success Rates: Often significantly higher, especially for commercial debts. Some firms report collection rates in excess of 80% for dollars placed versus dollars recovered, and commercial debt recovery rates around 72%. This is because the threat of legal action and the actual ability to litigate is a far more compelling motivator for debtors.

Why Attorneys Often Outperform Agencies:

The primary differentiator is the legal authority. Debtors are often “immune” to the pressure exerted by collection agencies because they know agencies cannot directly initiate legal proceedings. The involvement of an attorney, however, signals a clear intent to escalate the matter legally. This “attorney leverage” can be a powerful psychological tool, prompting debtors who might ignore an agency to engage seriously with an attorney.

Furthermore, attorneys are better equipped to handle complex or disputed debts. They can steer legal defenses, negotiate intricate settlement agreements, and pursue debtors who attempt to hide assets. For significant debts, or when a debtor is unresponsive to agency efforts, a collections attorney provides a more robust and effective path to recovery.

Comparison of Collection Agencies vs. Collections Attorneys

Hiring and Working with Business Collections Attorneys

Deciding when to engage a collections attorney is a strategic business decision. While it might seem like an extreme measure, there are specific scenarios where their expertise is not just beneficial, but essential.

When to Consider Hiring a Collections Attorney:

- Large or Significant Debts: For substantial outstanding amounts, the cost of legal action is often justified by the potential for recovery. The higher the debt, the more critical it is to employ robust legal strategies.

- Disputed Debts: If a debtor is actively disputing the amount owed, the quality of goods or services, or the terms of the agreement, an attorney can effectively steer these complexities. They can review contracts, gather evidence, and represent your interests in negotiations or court.

- Unresponsive or Evasive Debtors: When debtors ignore repeated attempts from your internal team or collection agencies, it’s a strong indicator that a more authoritative approach is needed. The legal weight an attorney carries can often break through debtor silence.

- Debtors with Known Assets: If you know the debtor has assets but is refusing to pay, an attorney can strategically pursue those assets through legal channels like liens or garnishments.

- When Legal Action is Imminent or Desired: If you anticipate needing to file a lawsuit, or if you’ve decided that litigation is the only path forward, an attorney is indispensable from the outset.

- Commercial Debt Recovery: For business-to-business debts, the stakes are often higher, and the legal framework more complex. Commercial debt recovery often benefits from the specialized knowledge of a collections attorney.

Finding a Reputable Collections Attorney:

Finding the right legal partner is paramount. A reputable attorney will not only be skilled in debt recovery but also operate ethically and transparently.

- Bar Associations: Start by checking with your state bar association. They often provide lawyer referral services and allow you to verify an attorney’s good standing and disciplinary history. The American Bar Association website is also an excellent resource for national referrals and state-specific links.

- Peer Recommendations: Ask other business owners, colleagues, or even your existing business attorney for recommendations. Personal referrals can be invaluable.

- Online Directories and Reviews: Websites like Justia, Avvo, and Lawyers.com list attorneys and often include client reviews and peer endorsements. Look for attorneys specializing in “collections,” “creditors’ rights,” or “business litigation.”

- Consultations: Most attorneys offer initial consultations, often free or at a reduced rate. Use this opportunity to discuss your case, assess their experience, and evaluate their communication style. Ask about their track record with similar cases and their proposed strategy. Attorneys experienced in consumer law or debt collection can help you understand your state and federal rights.

Understanding the Fee Structures for Business Collections Attorneys

The cost of hiring a collections attorney can vary significantly based on the complexity of the debt, the amount owed, and the attorney’s fee structure. Understanding these different models is crucial for managing your expectations and budget.

1. Contingency Fees:

This is one of the most common models for debt collection. Under a contingency fee arrangement, the attorney only gets paid if they successfully recover the debt. Their fee is a pre-agreed percentage of the amount collected.

- Pros: No upfront legal costs, aligning the attorney’s interests directly with yours. It’s often advertised as “No Collection = No Fee,” making it risk-free for the creditor.

- Cons: The percentage can be higher than other fee structures, especially for smaller debts or those requiring significant effort.

- Example: The Evanns Collection Law Firm, for instance, takes its judgment enforcement cases at NO UPFRONT COST TO YOU, illustrating this model effectively.

2. Hourly Rates:

The attorney charges a set hourly rate for their time spent working on your case. This includes research, communication, court appearances, and administrative tasks.

- Pros: Transparent billing for time spent.

- Cons: Can be unpredictable, especially for complex or prolonged cases. You pay regardless of whether the debt is collected.

- Best for: Cases where the debt is substantial, the legal work is expected to be extensive, or when the outcome is highly uncertain.

3. Flat Fees:

A fixed amount charged for specific services, such as drafting a demand letter or filing a lawsuit.

- Pros: Predictable cost for defined legal tasks.

- Cons: May not cover all eventualities, and additional work could incur extra charges.

- Best for: Simple, straightforward collection tasks where the scope of work is clear.

4. Hybrid Models:

Some attorneys combine elements of the above. For example, they might charge a reduced hourly rate plus a smaller contingency fee, or a flat fee for initial steps followed by a contingency if litigation becomes necessary.

- Pros: Offers a balance of predictability and performance incentives.

- Cons: Can be more complex to understand initially.

When discussing fees, always ask for a clear, written agreement detailing all costs, including court filing fees, process server fees, and other expenses (disbursements). A reputable attorney will be transparent about their pricing and help you choose the model that best suits your situation.

The Legal Boundaries of Debt Collection

While collections attorneys are powerful tools for debt recovery, their activities are strictly governed by federal and state laws designed to protect debtors from aggressive, unfair, or deceptive practices. Understanding these legal boundaries is crucial for both creditors and debtors.

The cornerstone of federal debt collection regulation is the Fair Debt Collection Practices Act (FDCPA). This act applies primarily to third-party debt collectors (including attorneys who regularly collect debts for others) and outlines prohibited conduct. The FDCPA makes it illegal for debt collectors to use abusive, unfair, or deceptive practices when they collect debts.

Key protections under the FDCPA include:

- Harassment Restrictions: Collectors cannot harass, oppress, or abuse any person. This means no threats of violence, obscene language, or repeated phone calls intended to annoy.

- Call Time Limits: Debt collectors can’t contact you before 8 a.m. or after 9 p.m. local time, unless you agree to it. They also cannot contact you at work if they know your employer prohibits such calls.

- Validation of Debt: Within five days of first contacting you, a debt collector must send you a written “validation notice” that tells you the amount of the debt, the name of the creditor, and your right to dispute the debt. If you don’t dispute the debt within 30 days of getting this information, the debt collector will assume the debt is legitimate.

- Ceasing Communication: You can send a written request to a debt collector to stop contacting you. Once they receive this, they can only contact you to confirm they will cease contact or to inform you of specific actions, like filing a lawsuit.

- Attorney Representation: Under federal law, a debt collector must go through your attorney if they know that you have one. This ensures that all communication is handled professionally and legally.

In addition to federal laws, state-specific laws often provide further protections or regulations. For example, states have different statutes of limitations for various types of debts. This is the legal time limit within which a creditor or collector can file a lawsuit to recover a debt. Once this period expires, the debt becomes “time-barred,” meaning a lawsuit cannot be filed, although collectors may still be able to contact you about the debt in some jurisdictions. It’s important to be aware of these varying state laws. For instance, in California, the statute of limitations for a written contract is generally four years.

Creditors engaging collections attorneys must ensure their chosen legal representation adheres to these regulations. Violations can lead to significant penalties for the collector and, in some cases, can even impact the creditor. If a debt collector breaks the law, debtors have the option to sue a collector in a state or federal court within one year of the violation.

Navigating the legal intricacies of debt collection requires expertise, which is why understanding the role of a collections attorney within the broader context of legal disputes and recovery is essential. This includes knowing when and how to engage legal counsel for effective and compliant debt recovery.

Frequently Asked Questions about Collections Attorneys

Here are some common questions businesses and individuals have when considering or working with collections attorneys:

How quickly can a collections attorney recover a debt?

The speed of debt recovery by a collections attorney is highly variable and depends on several influencing factors:

- Debtor Cooperation: If the debtor is willing to negotiate or pay, recovery can be relatively quick, sometimes within 30-45 days or less, especially with the pressure of an attorney demand letter.

- Legal Process Complexity: If a lawsuit is required, the timeline extends significantly. Court dockets, findy phases, and trial schedules can take months, or even over a year, depending on the jurisdiction and complexity of the case.

- Asset Location: The time it takes to locate and seize debtor assets can also impact the recovery timeline. If assets are readily identifiable, enforcement can be faster. If assets are hidden or difficult to trace, it will take longer.

- Amount and Nature of Debt: Smaller, undisputed debts might be resolved faster than large, complex commercial disputes.

While some collections can be swift, it’s more realistic to expect a process that could take several months if litigation is involved. Attorneys aim for faster results but are bound by legal procedures.

Can a collections attorney help with international debt?

Yes, many collections attorneys, particularly those with experience in commercial law or larger firms, can assist with international debt recovery. This often involves:

- International Networks: Attorneys may have networks of legal professionals in other countries with whom they can collaborate.

- Foreign Laws: Navigating international debt requires understanding the laws and legal systems of the debtor’s country, which can be vastly different from domestic laws.

- Enforcement Procedures: Enforcing a judgment obtained in one country in another country (e.g., a U.S. judgment in Canada or a European country) involves specific legal procedures and treaties, such as the Hague Convention.

If you have international receivables, it’s crucial to find an attorney with specific experience in cross-border collections to ensure compliance and effective strategy.

What happens if the debtor declares bankruptcy?

If a debtor declares bankruptcy, it significantly impacts debt collection efforts:

- Automatic Stay: Upon the filing of a bankruptcy petition, an “automatic stay” goes into effect. This is a court order that immediately halts most collection activities against the debtor. This means creditors and their attorneys must immediately cease all attempts to collect the debt, including phone calls, letters, and lawsuits.

- Attorney’s Role in Bankruptcy Court: While direct collection efforts stop, your attorney’s role shifts to representing your interests within the bankruptcy proceedings. They will:

- File a Proof of Claim: This is a formal document submitted to the bankruptcy court to establish your right to receive payment from the debtor’s assets (if any are available for distribution).

- Monitor the Case: Your attorney will track the bankruptcy proceedings to ensure your rights as a creditor are protected and to identify any opportunities for recovery.

- Challenge Discharge (in some cases): In certain circumstances, if the debt was incurred through fraud or other misconduct, your attorney might be able to challenge the dischargeability of your debt, meaning the debtor would still owe you even after bankruptcy.

While bankruptcy complicates recovery, an experienced collections attorney can help you steer the process and maximize your chances of receiving a portion of what you are owed.

Conclusion: Reclaiming Your Revenue and Peace of Mind

Unpaid debts are more than just numbers on a ledger; they represent lost opportunities, strained resources, and a direct threat to your business’s financial stability. While traditional collection methods have their place, there comes a point when the complexity, size, or resistance of a debt demands a more authoritative and legally backed approach.

Collections attorneys serve as your secret weapon in these scenarios. They bring not only legal expertise but also the power of the court system to bear, changing passive requests into active enforcement. From crafting potent demand letters and conducting thorough asset investigations to litigating cases and enforcing judgments through garnishments and liens, these legal professionals are equipped to steer the intricate path to debt recovery.

By understanding when to engage a collections attorney, what to provide them, and how their fee structures work, businesses can make informed decisions that significantly increase their chances of reclaiming what’s rightfully theirs. Moreover, being aware of the legal boundaries governing debt collection ensures that all efforts are compliant and ethical, protecting both the creditor and the debtor.

Proactive debt recovery, spearheaded by a skilled collections attorney, is not just about recouping lost revenue; it’s about protecting your business’s health, maintaining cash flow, and ultimately, securing your peace of mind. Don’t let unpaid invoices dictate your business’s future. Equip yourself with the knowledge and the right legal partner to ensure your hard work is always rewarded.